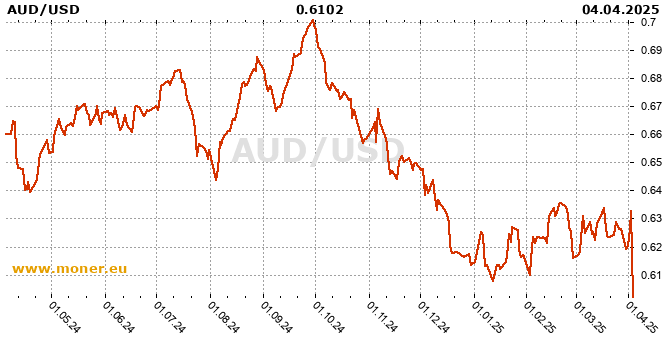

Some of the data investors should watch includes US and Australian inflation rates US, Australian and Chinese GDP Chinese manufacturing index figures and commodity prices.Ĭentral bank policy decisions have become an increasingly important driver for the currency markets in an environment where interest rates around the world are at record lows and governments are pumping money into their economies in an attempt to stimulate business activity. When trading currency pairs, investors need to be aware of the factors that drive the values of each currency and how those currencies relate to each other. The AUD/USD pair is one of the most actively traded on the currency markets, particularly given the fraught trading relationship between the US and China that has resulted in a trade war in recent years.įactors that influence the value of the AUD/USD pair

Currency traders use the Aussie as a proxy for taking positions on the Chinese economy, as China is Australia's largest export market. The US dollar is the world’s most traded currency, while the Australian dollar ranks fifth. The AUD vs USD currency pairing represents how many US dollars are needed to purchase one Australian dollar. The basics: what investors need to know about the AUD/USD pair

This AUD/USD analysis offers an overview of the factors influencing the pricing of the pair’s exchange rate, reviews its recent performance and looks at analyst forecasts for this forex giant heading into 2021. That creates volatility in the Australian dollar to American dollar currency pairing, providing great opportunities for investors to generate profits. The US dollar is the world’s reserve currency and responds not only to developments in the US economy but also global macroeconomic factors and financial markets. The Aussie is largely driven by the economic performance of China, its largest trading partner, as well as commodity markets, given that mining accounts for a large share of its domestic economy. Meanwhile the Australian currency has been supported by an improving Covid-19 outlook and economic recovery in China. The Aussie, as it is often called, has risen by 28 per cent against the US currency since March as the US economy remains under pressure. The Australian dollar (AUD) has made strong gains against the US dollar (USD) since the March lows in the financial markets.

0 kommentar(er)

0 kommentar(er)